If there was one key takeaway in the capstone panel at the legal symposium presented earlier this week by the National Association of Retail Collection Attorneys (NARCA) it was that provisions in the Fair Debt Collection Practices Act (FDCPA) add an unnecessary layer of regulation to a sector of the ARM industry already governed by strict professional standards: lawyers.

In the final panel of the event, “Attorney-Consumer Communications: A Roadmap to Resolution,” participants noted that provisions in the debt collection law, along with rulings in key cases, make communication between collection attorneys and consumers harder, even when the communication could benefit debtors.

Tomio Narita, an ARM defense expert with Simmonds & Narita, noted that the constraint felt by most debt collectors with regard to voicemails applies to collection attorneys as well. This prohibits potentially productive communication.

“The FDCPA should not be layered over rules of civil procedures for collection attorneys,” said Narita.

Narita’s example was expanded by David Schultz of Hinshaw & Culbertson. He said that with validation and dispute requirements, it’s not practical to offer the consumer a settlement in the first 30 days, even though only about 1 percent actually ask for validation.

The concern is that current law and court rulings are prohibiting one of the most important factors in a recovery relationship: early communication. Many consumers will not communicate with a collection attorney until action has been taken.

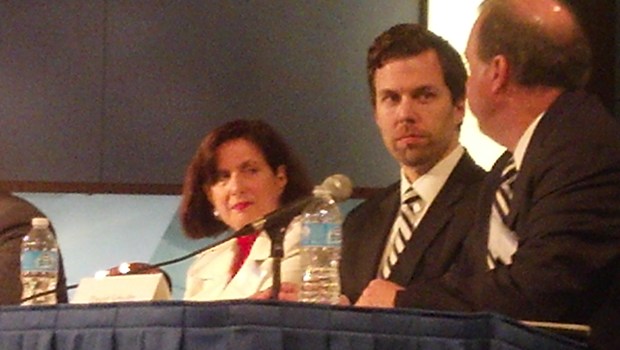

From left: Mary Colleen Beers, Fred Blitt, Alan Kaplinksy of Ballard Spahr, Laura Levine from Jump$tart Coalition, Tomio Narita

“Communication is key; the earlier the better,” said Fred Blitt of Blitt and Gaines. “It’s in our best interest for the consumer to respond to the initial communication. When we get a garnishment order, it’s kind of too late.”

Mary Colleen Beers, an in-house attorney with Capital One, echoed the sentiment. “My first move is not filing a lawsuit,” she said. “Customers need to engage early in the process.”

The Consumer Financial Protection Bureau’s (CFPB) representative on the panel agreed that communication was key in the attorney-consumer relationship, but he did not comment on the notion that the FDCPA’s provisions inhibit this. He did note, however, that the structure of the CFPB allows for more communication than ever before.

“The CFPB’s Consumer Response unit actually facilitates communication between collectors and consumers during the complaint response and resolution process,” said Scott Pluta, head of Consumer Response. The process opens a dialog between the consumer and the firm they have complained about, he noted.

Pluta also said that he feels this regulatory environment creates a competitive opportunity for good actors in the ARM industry.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)